Strategic Imperative for Investments in Innovation During Economic Uncertainty

Summary

In the current volatile economic landscape, characterized by the effects of protectionist tariff policies, market corrections, and rising interest rates, corporations are naturally tempted toward austerity measures like freezing hiring, halting new projects, and prioritizing short-term cost savings. However, purely defensive strategies, while potentially necessary for immediate survival, risk eroding long-term competitiveness.

Strategic investment in innovative startups, particularly through mechanisms like Corporate Venture Capital (CVC), presents a crucial, relatively low-commitment pathway for established companies. Such investments allow corporations to gain vital early signals about market shifts, access external innovation pipelines when internal resources may be constrained, and strategically position themselves to outperform competitors when economic recovery inevitably arrives. Historical analysis consistently demonstrates that companies maintaining or increasing their innovation focus during downturns emerge stronger and achieve accelerated growth in the subsequent years.

Uncertain Economic Conditions in Q1 2025

The first quarter of 2025 has presented corporate leaders with a complex and challenging economic landscape, driven heavily by the implementation of controversial new tariff policies by the Trump administration. Analyses suggest these tariffs contribute directly to higher consumer prices, with short-run increases estimated at 2.3% to 3.0%, translating to an average loss of purchasing power between $3,800 and $4,900 per household in 2024 dollars.(1) Certain sectors, like clothing, textiles, and automobiles, face particularly steep price hikes.(2)

Beyond inflation, these trade policies are casting a shadow over economic growth prospects. Forecasts indicate a potential reduction in US real GDP growth by 0.9 to 1.1 percentage points in 2025 due to the combined effects of tariffs and potential retaliation, leading to a persistently smaller economy in the long run, by about 0.6% or $160-$180 billion annually.(3)

Financial markets have reacted predictably to this uncertainty. The first quarter of 2025 witnessed significant stock market volatility, marking the worst quarterly performance for indices like the S&P 500 and NASDAQ Composite since 2022. Both indices entered correction territory (a decline of 10% or more from recent highs), with the NASDAQ experiencing its largest quarterly pullback since Q2 2022.(4) This market turbulence reflects investor concerns about the impact of tariffs, inflation, and potential recession risks.

This confluence of factors has tangibly impacted corporate sentiment and behavior. CEO and CFO confidence, which saw a post-election bump in late 2024, fell notably in Q1 2025, with tariffs and general uncertainty cited as top concerns.5 While the overall labor market remained relatively stable, with job growth continuing in March 2025, underlying trends suggest caution. Monthly job additions slowed compared to late 2024, and employers report taking a more measured approach, focusing on strategic hires rather than broad expansion.(6) Furthermore, CFO surveys indicate that tariff policies are negatively impacting capital spending plans for about a quarter of firms.(5)

The Perils of Playing Pure Defense: Why Austerity Alone Falls Short

In the face of economic headwinds and heightened uncertainty, the instinct for corporations is often to shift into a defensive posture. Prioritizing cost reduction, preserving cash flow, and maximizing operational efficiency are understandable and often necessary reactions. However, relying solely on these austerity measures represents a strategic pitfall with potentially severe long-term consequences. While essential for navigating immediate challenges, a purely defensive stance risks ceding critical ground to competitors and impairing the organization’s ability to capture growth when conditions inevitably improve.

History offers compelling evidence against the wisdom of wholesale retrenchment from growth-oriented investments during downturns. Research conducted by McKinsey & Company examining corporate performance through the 2008-2009 financial crisis revealed a striking divergence. Companies that maintained or increased their investment in innovation during that period outperformed the market average by more than 30% in the recovery phase and continued to deliver accelerated growth over the subsequent three to five years.(7) This finding underscores that downturns do not halt market evolution; in fact, shifts in customer needs and competitive dynamics often accelerate during such periods.(8)

Further analysis by Boston Consulting Group (BCG) reinforces this point. Studies show that acquisitions made during downturns, on average, generate significantly higher returns for buyers compared to deals initiated during economic booms. Examining performance across the last four major downturns, BCG found that approximately 14% of companies managed to increase both their sales growth rate and EBIT margins despite the challenging environment.(9) These resilient outperformers achieved revenue growth 14 percentage points higher and EBIT margin improvements 7 points greater than the 44% of companies that saw both metrics decline.(10) This substantial performance gap highlights the significant opportunity cost associated with overly aggressive cost-cutting that sacrifices future growth potential.

Playing solely defense overlooks the fact that economic downturns actively reshape the competitive landscape. BCG notes that “competitive volatility” – the rate at which companies rise or fall in competitive rankings – increases significantly during these periods.(10) This implies that relative market positions are more fluid and susceptible to change. Companies that merely hunker down risk being overtaken by more resilient competitors that manage to play both defense and offense. These forward-looking companies use the downturn not just to survive, but to strategically reposition themselves for future leadership.

Beyond the missed opportunity for strategic advancement, excessive austerity can inflict lasting damage on an organization’s capabilities. Deep cuts, particularly those impacting innovation pipelines, talent development, and R&D, can hollow out the company’s future growth engine. Ultimately, companies that prioritize short-term survival at the expense of all future-oriented investment will likely themselves become strategically irrelevant and unable to accelerate when more favorable market conditions return.

Why Downturns are Fertile Ground for Innovation

While economic downturns undeniably present challenges, they also create unique conditions that can be surprisingly fertile ground for innovation and the emergence of disruptive new ventures. Periods of constraint and uncertainty can catalyze shifts in market dynamics and resource availability that benefit agile and opportunistic players, particularly startups.

First, economic hardship forces changes in customer behavior and priorities. Needs shift, value perceptions are re-evaluated, and pain points often become more acute, creating openings for novel solutions that offer better value, efficiency, or address newly relevant problems. Startups, unburdened by legacy systems and often founded specifically to address such emerging needs, are frequently better positioned than incumbents to recognize and capitalize on these shifts.

Second, the austerity measures adopted by many large organizations during downturns directly create opportunities for smaller, more nimble startups. As incumbents pull back from exploring adjacent or disruptive market spaces, startups face less competitive pressure in testing and refining their innovations, allowing them to gain a foothold. Additionally, reduced competition for specialized talent can make it easier for startups to attract skilled employees let go from larger firms.

Third, economic downturns can alter the investment landscape in ways that favor strategic corporate investors. While overall venture funding may tighten, valuations for startups may become more attractive compared to peak market conditions, offering opportunities to invest in promising companies at potentially lower entry points. Although securing funding becomes more challenging for startups overall, the general market “noise” might decrease, allowing truly innovative signals to stand out more clearly.

The most compelling evidence for the innovative potential of downturns lies in the remarkable number of highly successful and disruptive companies founded during periods of economic crisis. The Great Recession of 2008-2009, despite being the most severe downturn in generations, witnessed the founding of numerous iconic technology companies that reshaped entire industries, including Airbnb, Slack, WhatsApp, Square, Uber, Pinterest, Venmo, and Instagram. Andreessen Horowitz, a leading venture capital firm, was itself founded during this period.

The success of these recession-born ventures demonstrates that resource constraints can foster discipline and focus, uncertainty can spur creative problem-solving, and shifting market needs can unveil significant untapped opportunities. For established corporations, this reality underscores the importance of remaining engaged with the innovation ecosystem, even – and perhaps especially – when economic conditions are challenging.

Corporate Venture Capital: A Smart Play in Uncertain Times

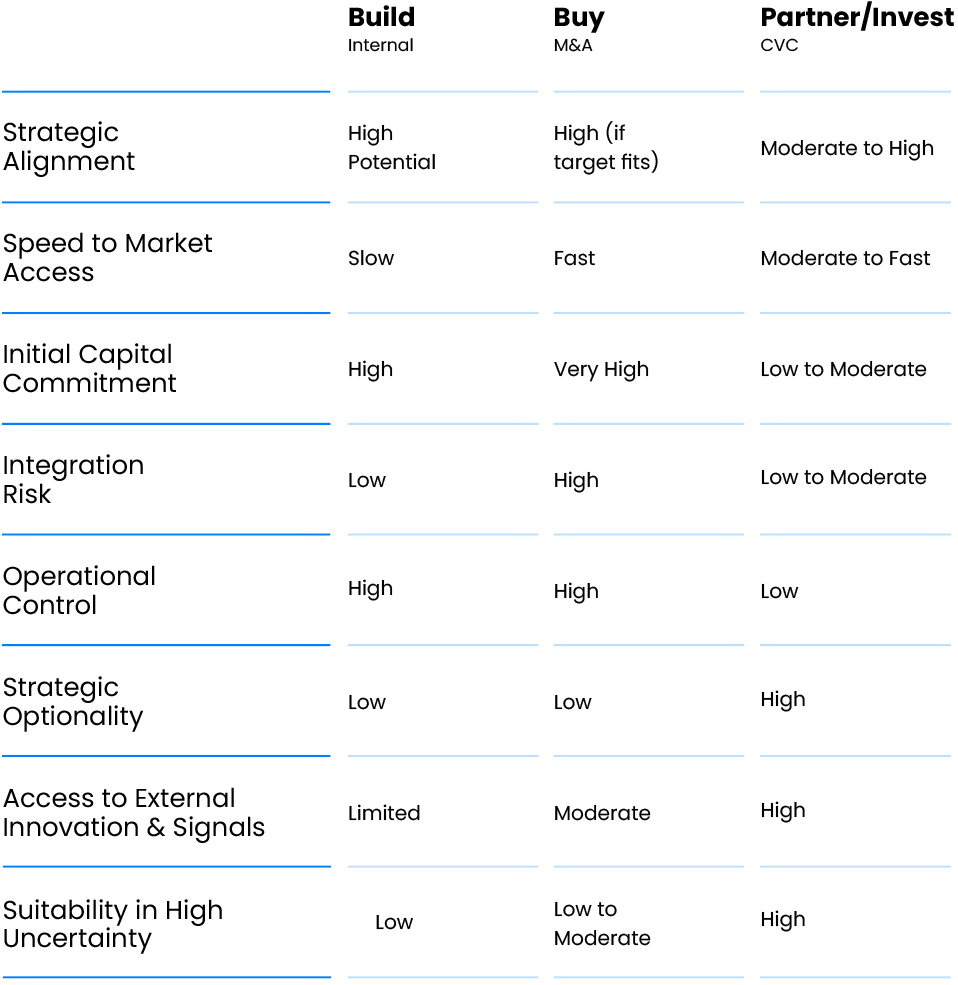

Given the unique challenges and opportunities presented by economic uncertainty, CVC emerges as a particularly adept instrument for corporations seeking to maintain innovation momentum and strategic positioning. Evaluating the options through the common strategic lens of “Build, Buy, or Partner” highlights the distinct advantages of CVC during turbulent periods.(11)

Build - Internal R&D / Venture Building

Developing innovations internally offers the highest degree of control and the potential for deep integration with existing operations. However, this is often resource-intensive, slow, and can be hampered by internal bureaucracy. During periods of economic uncertainty and austerity, the significant upfront capital commitment and long development timelines associated with major internal projects carry substantial risk. Budgets for ambitious, exploratory R&D are often among the first to be cut, potentially stalling crucial long-term innovation.

Buy - M&A

Acquiring another company can provide rapid access to new technologies, markets, or capabilities, offering high control over the acquired assets. However, M&A is typically the most expensive option, requiring significant capital outlay that may be unfeasible or imprudent during downturns. While downturn M&A can offer opportunities to acquire assets at lower valuations, targets may be distressed, adding complexity and risk. Once an acquisition is made, strategic flexibility can be reduced.

Partner/Invest - CVC

CVC, representing a form of strategic partnership through investment, offers a compelling balance of benefits particularly suited to uncertain times. Compared to internal builds or full acquisitions, CVC typically requires a lower initial capital commitment, preserving resources. Crucially, CVC affords high flexibility and optionality; as a minority investor, the corporation can learn and adapt, choosing to increase investment, pursue deeper partnerships, facilitate an acquisition (by itself or others), or exit the investment as market conditions and strategic priorities evolve. This structure effectively allows the corporation to hold a “real option” on future technologies or market positions with limited initial risk.(12)

Build vs. Buy vs. Partner/Invest Framework in Economic Uncertainty

Recent trends in CVC activity underscore its continued strategic importance. After a dip coinciding with the broader venture market slowdown, global CVC-backed funding saw a rebound in 2024, particularly in the US and Europe, reaching approximately $66 billion globally according to CB Insights.13 Despite a general decline in the overall number of venture deals, the average size of deals involving CVCs increased; however, early-stage deals (Seed and Series A) continued to represent a very high proportion of the number of CVC deals – around 65% in 2024, the highest in over a decade.13 This is consistent with the goal of accessing nascent innovations and early market signals.

Interestingly, the rate at which corporations acquire the portfolio companies of their own CVC teams remains low – historically below 4%.14 This seeming “paradox” reinforces the understanding that the primary drivers for many CVC teams extend beyond merely building an M&A pipeline. Strategic objectives such as gaining market insights, accessing new technologies, fostering ecosystem development, identifying potential partners, and achieving financial returns through exits to other parties (including IPOs or acquisitions by other companies) are often paramount.

This strategic focus, coupled with the inherent flexibility and lower upfront commitment, makes CVC a particularly potent tool for corporations aiming to innovate and position themselves strategically through periods of economic uncertainty.

The Resilience Dividend: Investing Today for Tomorrow’s Outperformance

The strategic imperative to invest in innovation during economic downturns is not merely about weathering the storm; it is about reaping a significant “resilience dividend” – emerging from the turbulence stronger, more adaptable, and positioned to accelerate past competitors during the recovery phase. Venture investments play a pivotal role in securing this dividend ecosystem as an extension of their innovation infrastructure, establishing a sustainable pipeline of intellectual property, human capital, and potential growth vectors—particularly valuable when conventional growth modalities encounter constraints.

Conclusion: Seizing the Counter-Cyclical Opportunity

The current economic climate, characterized by significant policy uncertainty, market volatility, and inflationary pressures, presents a demanding test for corporate leadership. The reflexive response towards deep austerity and an inward focus, while understandable, carries profound long-term strategic risks. History teaches a clear lesson: periods of economic downturn, while challenging, are also periods of significant competitive reordering. Companies that succumb entirely to defensive measures risk stagnation and decline, while those that strategically invest in innovation position themselves for significant outperformance during the inevitable recovery.

Downturns create unique opportunities for innovation. Shifting customer needs, the availability of talent, potentially advantageous valuations, and reduced competitive intensity from retrenching incumbents can create fertile ground for agile startups to emerge and thrive. These startups serve as critical sources of external innovation and vital market intelligence, acting as beacons that illuminate the path forward through

the fog of uncertainty.

CVC offers a uniquely suited mechanism for established corporations to engage with this dynamic startup ecosystem during uncertain times. Compared to strategically restrictive internal venture building projects, CVC provides a flexible, relatively low-commitment approach to access cutting-edge innovation, gain strategic foresight, and build valuable

optionality for the future.

The ultimate prize is the resilience dividend resulting from the innovation snowball effect: the ability to not only navigate the downturn but to accelerate ahead of competitors when growth returns. The evidence strongly suggests that counter-cyclical investment in innovation, facilitated effectively through CVC, is a key driver of this post-recession outperformance.

The call to action for corporate leaders is clear. Resist the temptation to focus solely on austerity and cost-cutting. While fiscal prudence is necessary, it must be balanced with strategic, forward-looking investments. Proactively engaging with the startup ecosystem through well-structured CVC programs or similar mechanisms is not a luxury to be deferred, but a strategic imperative for building long-term resilience and securing future market leadership. Seizing the counter-cyclical opportunity through strategic startup investment is essential for companies aiming to emerge from the current uncertainty not just intact, but ahead.

Key Takeaways

Q1 2025 presents a challenging economic landscape with protectionist tariff policies, market corrections, and rising interest rates triggering corporate austerity measures.

While cost-cutting measures are a rational and often necessary response to prepare for potentially prolonged economic downturns, organizations that focus exclusively on austerity without balancing these defensive actions with strategic innovation investments risk significantly eroding their long-term competitive positioning and growth potential.

Companies maintaining innovation focus during downturns consistently outperform market averages by 30%+ during recovery phases, with 14% of companies actually improving both growth and margins during challenging periods.

For corporations, CVC offers a balanced approach with lower initial capital requirements, high strategic optionality, and improved access to external innovation compared to internal R&D (venture building) or even full acquisitions.

Strategic innovation investment during economic uncertainty positions companies to emerge stronger when recovery inevitably arrives, allowing them to accelerate past competitors focused solely on short-term survival.